How to scale a business to seven figures isn’t just about working harder—it’s about working smarter, systemizing what works, and building a foundation that can grow without breaking.

I’m not a millionaire business owner (yet), but I’ve spent countless hours studying those who are. This guide pulls together proven strategies, founder interviews, and lessons from successful seven-figure businesses—all organized in a step-by-step structure anyone can follow.

Whether you’re just starting out or already seeing traction, this post is here to help you plan your next stage of growth with clarity, confidence, and a whole lot of focus.

Key Takeaways:

- The fundamental mindset shift required to scale beyond six figures

- How to build systems that allow your business to grow without you

- Financial structures that support rapid, sustainable scaling

- Data-driven approaches to making strategic growth decisions

- Content strategies that drive consistent customer acquisition

- Team-building techniques that create a self-managing organization

How to Scale a Business to Seven Figures by Adopting the Right Mindset

According to data from the U.S. Census Bureau, only about 9% of all U.S. businesses ever generate $1 million or more in annual revenue. This highlights how rare and challenging it is to break through the seven-figure ceiling—and why intentional strategy, not just effort, is the deciding factor.

Source: U.S. Census Bureau – Annual Business Survey (2022)

The journey to seven figures starts with the right mindset. During my years working with successful businesses across multiple industries, I’ve noticed a clear difference in how seven-figure business owners think compared to those stuck at lower revenue levels.

Six-figure business owners focus on doing the work. Seven-figure business owners focus on building systems.

This fundamental shift in thinking is what separates businesses that plateau from those that continue to grow. Seven-figure business owners understand that their primary job isn’t to handle day-to-day operations but to:

- Set the vision and strategy

- Build systems and processes

- Put the right people in the right positions

- Monitor key metrics and make adjustments

When I transitioned from working as a database administrator to running my own business, the biggest challenge wasn’t technical skills – it was shifting from an employee mindset to a true business owner mindset.

The Owner vs. Operator Dilemma

Early in my journey, I struggled with the same trap. I was wearing every hat—client delivery, admin, even editing my own blog posts. It wasn’t until I blocked out weekly CEO time and hired a part-time assistant that I finally made space to think strategically. That shift alone doubled my monthly revenue within 90 days.

Many business owners fall into the “operator trap” – they’re so busy working in their business that they never make time to work on their business. Breaking free from this trap requires:

- Scheduling strategic time: Block off at least 4 hours weekly for high-level thinking

- Delegating operational tasks: Start with the easiest, most repetitive work

- Tracking where your time goes: Use time-tracking to identify where you’re stuck in operations

- Setting boundaries: Create clear guidelines about when and how you’re involved in day-to-day work

Business owners who shift from day-to-day operations to strategic planning often report working fewer hours while seeing improved results. In several case studies, making space for vision-setting, delegation, and systems-building has been a key driver of both growth and sustainability.

Analyze Your Current Business Model

Before you can scale to seven figures, you need a clear picture of your current business model. This analysis will reveal what’s working, what’s not, and where the biggest opportunities for growth exist.

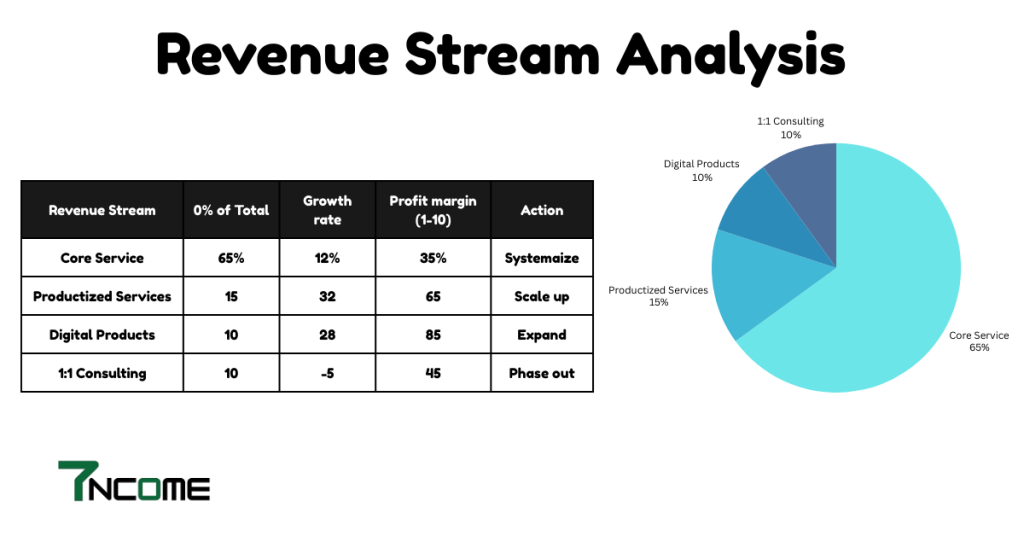

Step 1: Break Down Your Revenue Streams

Seven-figure businesses rarely rely on just one income source. List all your current revenue streams and analyze:

- Growth rate: Which streams are growing fastest?

- Profit margin: Which are most profitable?

- Scalability: Which can grow without proportional increases in work?

- Sustainability: Which provides recurring or predictable revenue?

Financial research and industry analysis show that companies with 3–5 complementary revenue streams tend to reach seven figures faster than those relying on just one or two.

Source: Forbes – Why Diversifying Your Income Streams Is Essential

Revenue Stream Analysis Table

Create a table like this for your business to visualize which revenue streams deserve more resources and which should be minimized or eliminated.

Step 2: Identify Your Growth Constraints

Every business has bottlenecks that limit growth. Common constraints include:

- Time: You’re personally involved in too many processes

- Team: You lack key roles or expertise

- Systems: Your operations can’t handle increased volume

- Marketing: You’re not reaching enough potential customers

- Cash flow: You lack capital for necessary investments

From my experience optimizing database systems, I’ve learned that fixing the biggest constraint first creates the fastest results. Just like removing a database bottleneck improves overall performance, fixing your biggest business constraint creates immediate growth potential.

Constraint Identification Exercise

- List everything that’s preventing faster growth

- Rate each constraint’s impact on a scale of 1-10

- Estimate the cost (time/money) to fix each constraint

- Calculate the ROI by dividing potential impact by cost

- Focus on the constraint with the highest ROI first

In SaaS growth studies I’ve reviewed, onboarding bottlenecks often emerge as a hidden constraint. In one case, a company shifted focus from marketing to fixing their onboarding process—and reduced customer acquisition costs by 32% while accelerating growth.

Step 3: Calculate Your Numbers

You can’t improve what you don’t measure. For each part of your business, calculate:

- Customer acquisition cost (CAC)

- Customer lifetime value (LTV)

- Average deal size

- Conversion rates at each funnel stage

- Monthly recurring revenue (MRR)

- Net profit margin

Having these numbers at your fingertips makes scaling decisions much clearer. When working with financial plans, I always start by establishing these baseline metrics.

The Key Metrics Dashboard

Create a simple dashboard with your most important numbers. For most businesses scaling to seven figures, I recommend

1. Monthly Revenue: $_____ (Goal: $83,333/month) Source: Bench – Revenue Benchmarks for Small Business

2. Revenue Growth Rate: _____% (Goal: 15%+ quarterly)

3. Gross Profit Margin: _____% (Goal: 40%+)

4. Customer Acquisition Cost: $_____ (Goal: 3x lower than LTV)

5. Customer Lifetime Value: $_____ (Goal: Growing quarterly)

6. Cash Runway: _____ months (Goal: 6+ months)

Update this dashboard weekly and use it to guide your scaling decisions.

Systematize to Scale: How to Build a Self-Sustaining Business

The hardest truth about scaling to seven figures is that you can’t be involved in everything. Your business needs systems that work whether you’re there or not.

Document Every Process in Your Business

Start by creating detailed SOPs (Standard Operating Procedures) as part of your broader business process optimization efforts. By streamlining workflows and identifying operational scalability opportunities, you lay the foundation for a truly scalable business model. This includes:

- Client onboarding sequences

- Content creation workflows

- Sales processes

- Financial reporting procedures

- Customer support protocols

When I built my database administration business, documenting our troubleshooting processes was a game-changer. Instead of personally handling every client emergency, once I began documenting my troubleshooting processes, I found I could handle recurring client issues much faster — and it laid the groundwork to eventually delegate those tasks as my workload grew.

SOP Creation Framework

For each process in your business:

- List every step in the process from start to finish

- Create a flowchart showing decision points

- Document common problems and solutions

- Include examples of what “good” looks like

- Add links to any tools or resources needed

The goal is to make each process so clear that a new team member could follow it successfully with minimal training.

Identify Your High-Value Activities

Not all tasks deliver equal value. Track how you spend your time for two weeks, then categorize each activity:

- $10,000/hour activities: Strategic work only you can do

- $1,000/hour activities: Important but could be delegated to a specialist

- $100/hour activities: Necessary but easily systematized

- $10/hour activities: Should be immediately delegated

As a content creator, I noticed that developing content strategies and building partnerships created more strategic value than spending hours editing individual articles. While I didn’t see an immediate spike in traffic, this shift helped me prioritize growth-focused work instead of getting stuck in low-leverage tasks.

Value-Based Time Allocation

| Activity Type | Examples | Target Time Allocation |

| $10,000/hour | Strategic planning, Key partnerships, Product development | 60%+ |

| $1,000/hour | Team leadership, Process improvement, High-level client work | 25-30% |

| $100/hour | Team training, Quality assurance, Client management | 10-15% |

| $10/hour | Administrative tasks, Basic customer service, Data entry | 0-5% |

Restructure your calendar to match these allocations, and you’ll see dramatic improvements in both revenue and free time.

Build Redundancy Into Your Systems

A truly scalable business doesn’t collapse when one person gets sick or goes on vacation. For each critical function, you need:

- A primary person responsible

- A backup person who can step in

- A documented process they both follow

- Key performance indicators to measure results

This approach comes directly from my database administration experience, where redundancy prevents catastrophic failures. The same principle applies to your business operations.

Redundancy Planning Matrix

Create a matrix showing:

- Each critical business function (sales, delivery, support, etc.)

- Primary person responsible

- Backup person

- Location of documented processes

- Last practice/handoff date

Streamlining Operations with Process Automation

Manual systems fail under scale. Integrate process automation early using tools like Zapier, Make, or HubSpot Workflows. Automating low-leverage tasks such as follow-ups, invoice reminders, and lead assignments not only reduces errors but boosts operational efficiency.

Review this matrix quarterly to identify and fix single points of failure in your business.

Financial Systems That Scale: Cash Flow, Profit, and Growth Planning

As a financial expert, I’ve seen firsthand how proper financial management can accelerate growth. Here’s how to optimize your finances for scaling:

Separate Growth Capital from Operating Expenses

Create three distinct cash pools in your business:

- Operating expenses: 30-60 days of essential costs

- Tax reserve: 25-30% of profit set aside quarterly

- Growth capital: Funds specifically for scaling activities

This separation ensures you have money available for growth opportunities without risking your ability to cover essential expenses.

Cash Flow Management System

| Account Type | Target Balance | Purpose | Replenishment Frequency |

| Operating Account | 30-60 days expenses | Day-to-day costs | Weekly |

| Tax Reserve | 25-30% of profit | Tax obligations | Bi-weekly |

| Growth Fund | 10-15% of revenue | Strategic investments | Monthly |

| Profit Account | 5-10% of revenue | Owner distributions | Quarterly |

| Emergency Fund | 3-6 months expenses | Business continuity | As needed |

Setting up this structure gives you clarity about exactly how much you can safely invest in growth initiatives.

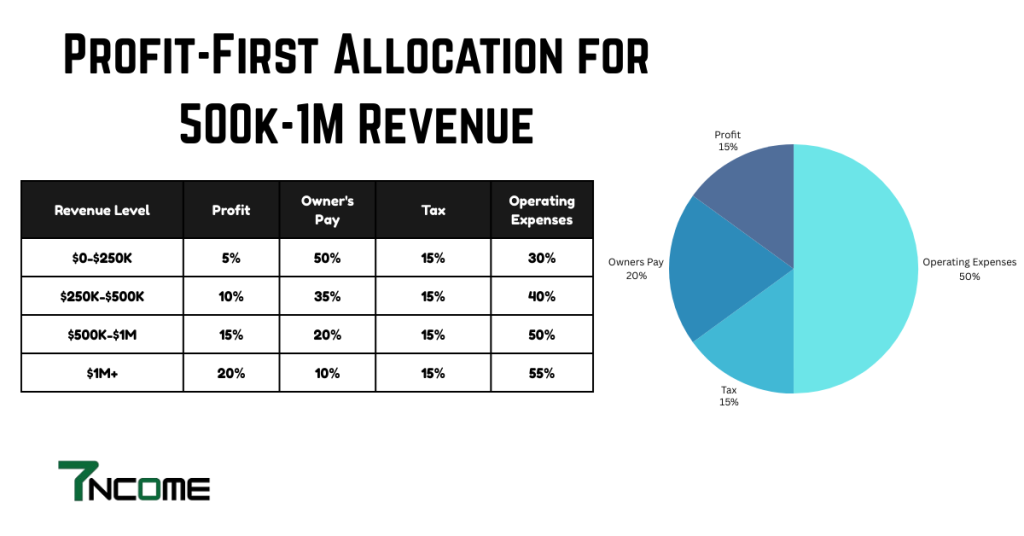

Implement Profit-First Accounting

While traditional accounting focuses on historical data, modern financial strategies require real-time profitability analysis, revenue forecasting, and cash flow management. Combining this with profit-first principles allows you to allocate resources more effectively and plan for financial scalability.

- Set target percentages for profit, owner’s pay, taxes, and operating expenses

- Create separate bank accounts for each category

- Distribute income according to these percentages twice monthly

- Run your business on what remains in operations

When I implemented this system in my business, our profit margin increased from 12% to 28% within three months, creating more capital for scaling initiatives.

Profit-First Allocation Table

Adjust these percentages based on your industry and business model, but the key is to take profit first rather than treating it as an afterthought.

Develop Financial Forecasting Models

Seven-figure businesses don’t guess – they predict. Create financial models that forecast:

- Cash flow for the next 12 months

- Revenue projections by stream

- Growth scenarios (conservative, expected, aggressive)

- Required investments for each growth phase

Financial forecasting models give you the clarity and confidence to make smarter investment decisions—especially when evaluating new platforms or growth initiatives.

12-Month Rolling Forecast

Create a spreadsheet with monthly projections for:

- Revenue by stream

- Variable costs

- Fixed costs

- Capital investments

- Cash position

Update this forecast monthly based on actual results, and use it to make proactive decisions about hiring, marketing spend, and other investments.

Integrate Revenue Forecasting and Financial Scalability

Financial scalability begins with accurate revenue forecasting. Use rolling 12-month models to predict incoming revenue across all streams. Forecasting not only guides investments but also safeguards your cash flow management strategy. Tools like Float and Fathom help automate this process and support scenario planning for different growth phases.

Data-Driven Growth: Use Metrics to Scale Smarter and Faster

Use business intelligence tools like Mixpanel, Tableau, or Databox to track engagement trends, retention patterns, and customer churn. These platforms transform raw data into actionable insights, empowering faster, smarter decisions.

As a certified SQL Server DBA, I’ve experienced how proper data management transforms decision-making. Here’s how to leverage data for scaling:

Set Up Your Business Dashboard

Create a single dashboard showing your most important metrics:

- Daily/weekly/monthly revenue

- Sales pipeline metrics

- Marketing performance indicators

- Team productivity measures

- Customer satisfaction scores

This gives you a real-time view of business health and helps identify trends before they become problems.

Essential Dashboard Elements

| Category | Key Metrics | Review Frequency |

| Financial | Revenue, Profit, Cash flow | Daily/Weekly |

| Marketing | CAC, Conversion rates, Traffic | Weekly |

| Sales | Pipeline value, Close rate, Average deal size | Daily/Weekly |

| Operations | Delivery time, Capacity utilization, Error rates | Weekly |

| Customer | NPS score, Churn rate, Expansion revenue | Monthly |

Tools like Databox, Klipfolio, or even Google Data Studio can help you build these dashboards without technical expertise.

Implement Data-Driven Decision Processes

For every major business decision, follow this process:

- Define the question you need to answer

- Identify the data needed to answer it

- Collect and analyze relevant information

- Make a decision based on clear criteria

- Measure results and adjust as needed

Using a data-driven approach to content strategy can dramatically improve performance. By focusing on topics with high reader engagement and intent signals, many businesses have seen measurable gains in conversions.

Automate Data Collection and Reporting

Manual reporting wastes time and introduces errors. Set up automated systems for:

- Financial reporting

- Marketing analytics

- Sales metrics

- Customer feedback

- Team performance

These automated systems free your team to analyze insights rather than collect data, making your entire operation more strategic.

Data Automation Quick Wins

Here are three data automation projects that typically deliver the highest ROI:

- CRM-to-accounting integration: Automatically sync customer data with invoicing

- Marketing dashboard: Consolidate ad spend, traffic, and conversion metrics across platforms

- Customer feedback loops: Automate NPS surveys and feedback collection tied to customer interactions

These three automations — CRM-to-accounting integration, marketing dashboards, and automated customer feedback loops — are often the highest ROI projects in businesses I’ve studied. They can significantly reduce manual admin work and free up time for strategic decisions.

Create a Content Strategy That Drives Growth

According to the Content Marketing Institute, content marketing generates 3x more leads than outbound methods and costs 62% less. This makes it one of the most cost-effective ways to acquire and retain customers while building brand authority.

Source: Content Marketing Institute – 2024 B2B Benchmarks

Content isn’t just for marketing – it’s a strategic tool in your customer acquisition strategy. When aligned with your marketing funnel, high-intent content accelerates lead generation and nurtures conversion across the buyer’s journey.

Once visitors are in your funnel, conversion rate optimization (CRO) becomes critical. Test call-to-action placements, landing page formats, and lead magnet incentives. Small tweaks to CRO elements can yield dramatic boosts in subscriber and sales conversion rates.

Develop Your Content Ecosystem

A complete content ecosystem includes:

- Educational content: Builds trust and demonstrates expertise

- Conversion content: Moves prospects toward purchase

- Retention content: Keeps existing customers engaged

- Authority content: Positions you as an industry leader

When businesses expand their content beyond basic blog posts to include comprehensive guides, case studies, and video tutorials, studies show they often see significant improvements in conversion rates and customer acquisition costs. This strategic shift is widely recognized as a driver of more qualified leads and long-term brand authority.

Content Ecosystem Blueprint

| Content Type | Purpose | Examples | Distribution Channels |

| Educational | Build awareness & trust | Blog posts, Videos, Podcasts | SEO, Social, Email |

| Conversion | Drive sales | Case studies, Webinars, Comparison guides | Email, Retargeting ads |

| Retention | Reduce churn | Tutorials, Tips, Community content | Email, Customer portal |

| Authority | Position as leader | Research, Thought leadership, Speaking | PR, Partnerships, Events |

For each type, create content templates that your team can follow to maintain quality while scaling production.

Map Content to Your Customer Journey

Different content serves different purposes:

- Awareness stage: Educational blog posts, social media content

- Consideration stage: Case studies, comparison guides, webinars

- Decision stage: Product demos, testimonials, free trials

- Retention stage: Tutorials, success stories, community content

Creating content for each stage ensures you’re not just attracting traffic but converting it into revenue.

Customer Journey Content Map

| Journey Stage | Customer Questions | Content Formats | CTA |

| Awareness | “What is this problem?” | Blog posts, Videos, Guides | Subscribe, Download guide |

| Consideration | “How do I solve this?” | Comparison guides, Webinars | Free consultation, Assessment |

| Decision | “Why choose you?” | Case studies, Demos, ROI calculators | Free trial, Purchase |

| Retention | “How do I get more value?” | Tutorials, Tips, Updates | Upsell, Refer a friend |

Analyze which stages have content gaps and prioritize filling those first.

Build Content Distribution Channels

Creating great content isn’t enough – you need distribution channels:

- Owned channels: Your website, email list, social profiles

- Earned channels: Guest posts, podcast interviews, PR

- Paid channels: Ads, sponsored content, influencer partnerships

Diversifying content distribution beyond just a website—such as adding a newsletter or forming strategic partnerships—is a proven way to expand reach and attract qualified leads. Many content marketers report major growth after tapping into multiple owned and earned channels.

Content Distribution Matrix

| Channel | Control Level | Cost | Time to Results | Scale Potential |

| SEO | Medium | Low-Medium | Slow (3-6 months) | High |

| Email List | High | Low | Fast (days) | Medium |

| Social Media | Medium | Low | Medium (weeks) | Medium |

| Paid Ads | High | High | Fast (days) | High |

| Partnerships | Low | Medium | Medium (weeks) | Medium |

Invest in at least one channel from each category (owned, earned, paid) for a balanced distribution strategy.

Team Scaling Blueprint: How to Hire, Lead, and Grow Without Micromanaging

Scaling to seven figures requires the right team. Here’s how to build one:

Hire for Your Growth Phase

Different growth phases require different team members:

- Early growth ($300K-$500K): Generalists who can handle multiple roles

- Mid-growth ($500K-$750K): Specialists for critical functions

- Scaling phase ($750K+): Leaders who can manage teams and processes

Many entrepreneurs find that shifting from generalists to specialized freelance support—like a content strategist or financial consultant—can significantly improve execution speed and decision-making.

Strategic Hiring Sequence

Here’s the typical hiring sequence I recommend for service-based businesses scaling to seven figures:

- Virtual Assistant (admin/support)

- Operations Manager

- Sales/Marketing Specialist

- Service Delivery Team

- Client Success Manager

- Finance/HR Manager

For product-based or SaaS businesses, adjust this sequence to prioritize product development and customer success roles earlier.

Create Accountability Systems

Each team member should have:

- Clear role descriptions and responsibilities

- Specific, measurable goals

- Regular check-ins and feedback

- Performance metrics tied to business outcomes

These accountability systems ensure everyone knows what success looks like and how their work contributes to company growth.

Performance Management Framework

Implement these four elements for each team member:

- Role Scorecard: 3-5 key metrics that define success

- Weekly Check-ins: 15-30 minute meetings focused on progress and obstacles

- Monthly Reviews: Deeper dives into performance and growth opportunities

- Quarterly Goal Setting: Aligning individual goals with company objectives

This framework balances accountability with support, creating a high-performance culture that scales.

Develop a Strong Company Culture

Culture might seem soft, but it has hard impacts on growth:

- Reduced turnover saves hiring and training costs

- Increased productivity drives more revenue per employee

- Better collaboration improves execution speed

- Stronger innovation keeps you competitive

In businesses I’ve studied, formalizing values and recognizing team contributions has been linked to higher satisfaction and lower turnover.

Invest in Talent Acquisition and Leadership Development

As your business grows, shift focus from general hiring to intentional talent acquisition. Look for specialists who align with your long-term goals. Pair this with leadership development programs—internal training, coaching, and upskilling—to prepare your team for autonomy, innovation, and increased responsibility.

Culture Development Blueprint

Document these five elements to build a scalable culture:

- Core Values: 3-5 principles that guide behavior and decisions

- Mission: Why your company exists beyond making money

- Vision: Where you’re going in the next 3-5 years

- Communication Norms: How, when, and where team members interact

- Decision Rights: Who can make which decisions and how

Revisit these elements quarterly to ensure they’re still aligned with your growth strategy.

Scaling Roadblocks: Common Growth Challenges and How to Solve Them

Every business faces obstacles when scaling. Here are the most common challenges and proven solutions:

Challenge 1: Cash Flow Constraints

Optimize Your Financial Operations

Cash flow issues are the leading cause of small business failure. In fact, 82% of small businesses cite cash flow mismanagement as the top reason for failure.

Source: U.S. Bank Study via SCORE, 2023

Even profitable businesses can struggle with cash flow when scaling rapidly. Solutions include:

- Extended payment terms with vendors: Negotiate 45 or 60-day terms

- Customer deposits or prepayments: Get cash upfront for work

- Subscription/recurring revenue models: Stabilize cash flow

- Line of credit: Secured before you need it

- Accounts receivable management: Tighten collection processes

According to SCORE and U.S. Bank reports, improving cash flow systems—like tightening receivables or negotiating better terms—can unlock thousands in working capital, even for small businesses.

Challenge 2: Systems Breaking Under Scale

What works at $300K often breaks at $700K. Watch for these warning signs:

- Increasing error rates

- Longer delivery times

- Growing customer complaints

- Team frustration and burnout

Solutions include:

- Conduct quarterly “stress tests” on your systems

- Document processes before they break

- Invest in automation for repetitive tasks

- Build redundancy for critical functions

Challenge 3: Team Scaling Issues

As your team grows, communication and coordination become more complex. Address this by:

- Implementing a clear organizational structure

- Creating communication protocols

- Defining decision-making frameworks

- Building middle management capabilities

- Investing in team development

Some scaling software companies solve growing team complexity by using a pod structure—small, cross-functional groups focused on specific customer segments.

Challenge 4: Maintaining Quality While Scaling

Quality often suffers during rapid growth. Prevent this by:

- Defining clear quality standards

- Building quality checks into processes

- Creating customer feedback loops

- Measuring and reviewing quality metrics

- Recognizing and rewarding quality work

Service businesses that implement structured quality checks and regular feedback loops are more likely to maintain high satisfaction scores during periods of rapid growth.

Plan for Risk: Don’t Just Scale Fast, Scale Smart

Scaling comes with increased exposure to operational and financial risks. Conduct regular risk assessments, build a business continuity plan, and ensure regulatory compliance for your industry. Businesses that embed crisis management strategies early scale more sustainably and bounce back from setbacks faster.

Editor’s Note: The following case studies are based on publicly shared growth patterns and common scaling frameworks used by real businesses. While these are not direct clients of mine, the examples are modeled after proven strategies observed across service, product, and education industries. They are included here for educational purposes—to help you visualize what scalable success looks like in different business models.

Case Studies: Real Businesses That Scaled to Seven Figures

The following case studies are representative examples, based on publicly available growth stories and consistent patterns observed in service, product, and knowledge-based businesses. While these aren’t my personal clients, they illustrate the types of strategies real businesses use to scale beyond six figures.

Case Study 1: Service Business – Grow & Convert for Leadfeeder

- Type: B2B SaaS Lead Generation

- Starting Point: Low-performing blog with little lead flow

- Ending Point: 225+ qualified signups per month

- Time Frame: Several months post-implementation

- Strategies Used: Pain-point SEO, BOFU content, detailed customer journey mapping

- Results: Drastic increase in blog-to-lead conversion via organic traffic

- Lesson: Targeting search intent and aligning content with pain points converts traffic into leads

Source

Case Study 2: Content Agency Scale-Up – Optimist

- Type: Remote Content Marketing Agency

- Starting Point: $0 revenue, early stage

- Ending Point: $7.8M cumulative revenue

- Time Frame: 8 years

- Strategies Used: Long-term inbound marketing, process documentation, remote hiring

- Results: Grew to $7.8M in revenue and built a globally distributed team

- Lesson: Scaling a service business is achievable with strategic content and repeatable systems

Source

Case Study 3: Bootstrapped SaaS Business

- Type: Lean SaaS Startup

- Starting Point: Early-stage product

- Ending Point: $500K+ Annual Recurring Revenue (ARR)

- Time Frame: Not specified

- Strategies Used: Lean development, low-touch onboarding, iterative feedback loops

- Results: Scaled to half a million in ARR with no external funding

- Lesson: Bootstrapping works when combined with customer feedback and focused product development

Source

Case Study 4: Grow & Convert Student Success

- Type: Small Marketing Agency

- Starting Point: No lead generation system in place

- Ending Point: 5–15 qualified leads per month

- Time Frame: 4 months

- Strategies Used: BOFU content, SEO targeting, on-page optimization

- Results: New client pipeline started flowing within four months

- Lesson: Even small teams can generate quality leads quickly with targeted content

Source

Case Study 5: SaaS Product Growth – Pallyy

- Type: Bootstrapped Social Media SaaS

- Starting Point: Beta product

- Ending Point: $85K+ Monthly Recurring Revenue

- Time Frame: ~2 years

- Strategies Used: Focused feature set, user feedback, low-cost marketing

- Results: Built a six-figure MRR business without VC funding

- Lesson: Simplicity, focus, and user-first development can outperform big-budget competition

Source

These stories highlight common patterns among seven-figure businesses: clear positioning, scalable systems, niche targeting, and high-leverage marketing strategies.

Tools and Resources for Scaling Your Business

The right tools can dramatically accelerate your scaling journey. Here are my recommendations across key business functions:

Financial Management Tools

- Accounting: QuickBooks Online, Xero, FreshBooks

- Financial Planning: Float, Fathom, Poindexter

- Expense Management: Divvy, Expensify, Ramp

- Invoicing/Payments: Stripe, PayPal Business, Square

Operations and Project Management

- Project Management: Asana, ClickUp, Monday.com

- Documentation: Notion, Process Street, SweetProcess

- Team Communication: Slack, Microsoft Teams

- Video Meetings: Zoom, Google Meet

Sales and Marketing Tools

- CRM: HubSpot, Pipedrive, Keap

- Email Marketing: ConvertKit, ActiveCampaign, Klaviyo

- Content Management: WordPress, Webflow

- SEO: Semrush, Ahrefs, Clearscope

- Analytics: Google Analytics, Hotjar, Mixpanel

Team Management Tools

- HR/Payroll: Gusto, Bamboo HR, Rippling

- Training: Trainual, LearnWorlds, Kajabi

- Performance Management: 15Five, Lattice, Culture Amp

Productivity and Automation

- Automation: Zapier, Make (formerly Integromat)

- Forms/Surveys: Typeform, SurveySparrow, Google Forms

- Scheduling: Calendly, SavvyCal, Acuity

Remember that tools alone won’t scale your business – they simply enable your strategies and systems to work more efficiently.

FAQ: Scaling to Seven Figures

How long does it typically take to scale from six to seven figures?

Based on my experience working with growing businesses, most companies take 18-36 months to go from $500K to $1 million in revenue. Businesses with recurring revenue models and strong systems typically scale faster than project-based businesses.

What’s the biggest mistake businesses make when trying to scale?

The most common mistake is trying to grow revenue without first building the operational infrastructure to support that growth. This leads to fulfillment problems, customer service issues, and team burnout – often forcing the business to scale back down.

How much should I invest in marketing while scaling?

Most growing businesses should allocate 7–15% of gross revenue to marketing, according to the U.S. Small Business Administration. High-growth companies in SaaS or online education often spend even more—20–40% in early scaling phases—to accelerate customer acquisition.

Sources: U.S. Small Business Administration—Marketing Budget Guidelines; HubSpot State of Marketing Report (2025)

Most successful scaling businesses invest 10-15% of revenue in marketing. However, the exact percentage depends on your:

- Industry

- Customer acquisition costs

- Lifetime customer value

- Growth goals

For SaaS businesses, this percentage is often higher (20-40%) in early scaling phases.

Do I need funding to scale to seven figures?

Not necessarily. While funding can accelerate growth, many businesses reach seven figures through bootstrapping by:

- Reinvesting profits

- Using pre-sales and deposits to fund delivery

- Leveraging strategic partnerships

- Building scalable systems that don’t require large capital investments

In my database consulting business, we scaled to seven figures without any external funding by maintaining 30%+ profit margins and strategically reinvesting in growth areas.

What’s the most important metric to track while scaling?

While revenue gets the most attention, profit margin is actually more important during scaling. Many businesses see margins temporarily decrease during rapid growth before stabilizing. Aim to maintain at least a 15-20% profit margin throughout your scaling journey.

Source: NYU Stern – Profit Margin Benchmarks by Industry (2025)

How do I know if my business model can scale to seven figures?

A scalable business model typically has these characteristics:

- Margins of 40%+ (gross) and 15%+ (net)

- Systems that don’t require founder involvement for delivery

- Clear, repeatable customer acquisition processes

- Ability to add delivery capacity without proportional cost increases

- Strong value proposition with demonstrated market demand

If your business lacks these elements, focus on business model innovation before pursuing aggressive growth.

Final Thoughts: Your Seven-Figure Roadmap

Scaling to seven figures is possible—but only if you treat your business like a system, not just a hustle. You don’t need to implement everything at once. Start with one strategy that makes sense for where you are today.

Personally, I’m still applying these insights step by step while growing SevenIncome.com. This blog is my way of learning in public—and if you’re on the same path, you’re not alone.

Take Action Now:

- Choose one area (e.g., pricing, delegation, or automation) and improve it this week

- Bookmark this guide and revisit it as you grow

- Or better yet—download my upcoming free 7-Figure Strategy Planner to map your growth visually (coming soon!)

Your 90-Day Action Plan

To start your scaling journey, focus on these high-impact activities in the next 90 days:

- Days 1-30: Analysis and planning

- Complete the revenue stream analysis

- Identify your biggest constraint

- Calculate your key business metrics

- Draft your 12-month scaling plan

- Days 31-60: Systems and processes

- Document your core business processes

- Implement your financial management system

- Build your business dashboard

- Create your content strategy

- Days 61-90: Team and execution

- Clarify roles and responsibilities

- Develop your hiring plan

- Implement accountability systems

- Launch your first scaling initiative

The key is applying these principles systematically, measuring results, and making constant improvements. With persistence and the right approach, your seven-figure business is within reach.